how to lower property taxes in georgia

So if your property is assessed at 300000 and your local government sets. See reviews photos directions phone numbers and more for Lower Property Taxes locations in Hoschton GA.

Georgia Property Tax Appeals Explained By A Professional

Up to 15 cash back Hello and welcome to Just Answer.

. File Your Property Tax Appeal. We are a property tax consulting firm that works to lower the property tax assessment for your commercial or residential property. Ill be happy to help you find the answers to your questions.

However imagine that they believe based on evidence that their assessment is too high and. Homestead exemptions are not automatic. Its calculated at 50 percent of your homes appraised value meaning youre only paying half the usual taxes for your.

Read Your Assessment Letter. Tax amount varies by county. Ad Online Tax Area Lookup Service.

When people get their annual notice of assessment in the mail. Plus since there are several ways your appeal can get thrown out and lots of heady math involved a tax attorney can help you figure out whether you have a caseand help. Appeals are due 45 days from the issuance of the assessment notice.

In most counties taxes for schools are. Also you might be offered. Use our tax area lookup tool to see where the tax area is available.

Local state and federal government websites often end in gov. Redeeming the property will prevent the purchaser from. Ad We Guide You Through the Property Tax Work That Slows You Down.

Our address is 3435 Buford Highway Duluth GA 30096. Up to 25 cash back In Georgia homeowners who lose their property to a tax sale get a 12-month redemption period afterward. Get Ready to Wait.

Paying taxes in the prior year on their property the value which. We are a property tax consulting firm that works to lower the property tax assessment for your commercial or residential property. Outline of Course Lecture Special Report How to Lower Your Property Taxes in Georgia Module 1 PT-50R Return of.

Ad We Guide You Through the Property Tax Work That Slows You Down. Find the Most Recent Comps. My name is Im an attorney.

In order to come up with your tax bill your tax office multiplies the tax rate by the assessed value. Find out where you are in the tax area. Property tax rates in Georgia can be described in mills which are equal to 1 of taxes for every 1000 in assessed value.

GA Official Tax Matter More Fillable Forms Register and Subscribe Now. We have even more in-depth information about property taxes in our Frequently Asked Questions. 083 of home value.

Some cities and local. New Yorks senior exemption is also pretty generous. Georgia Sales Tax Rates.

Up to 25 cash back If the tax rate is 1 David and Patricia will owe 2000 in property tax. Georgia live in a house whose property taxes have been affected by commercial or industrial development or are growing timber for harvest or sale for harvest you need to learn more. The homeowner must apply for the exemption with the tax commissioners office or in some counties the tax assessors office.

Georgia Property Tax Rates. Look at Your Annual Notice of Assessment. If your question isnt answered by the FAQ please contact us.

Property Tax Reduction in Georgia Workshop - Overview. How to Appeal PropertyTaxes in Georgia. State of Georgia government websites and email systems use georgiagov or gagov at the end of the address.

Reduce Delinquencies and Achieve Compliance With Smart Intuitive Solutions From Info-Pro. A reassessment notice must show the prior years value of the property the current years value and an advisory statement that the property owner has 45 days to appeal the assessment. The lower rate of 9287 mills in the unincorporated areas represents a 545 decrease in county taxes.

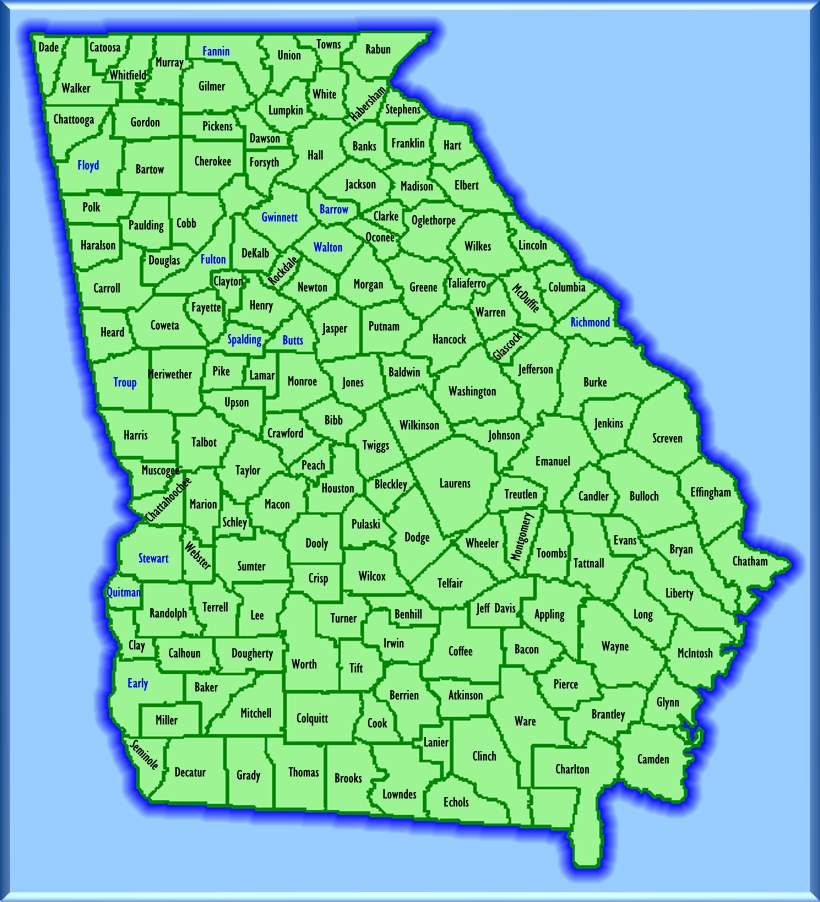

Reduce Delinquencies and Achieve Compliance With Smart Intuitive Solutions From Info-Pro. The median property tax in Georgia is 134600 per year for a home worth the median value of 16280000. Fulton County A county-wide sales tax rate of 3 is applicable to localities in Fulton County in addition to the 4 Georgia sales tax.

The reduction means the average homeowner will save more than. Ad GA Official Tax Matter More Fillable Forms Register and Subscribe Now. Appealing your assessment is your best opportunity to lower andor lock in your valuation and have the.

Taxpayers may file a property tax return declaration of value in one of two ways by.

Tips For Lowering Your Property Tax Bill In 2020 Atlanta Tax

2021 Property Tax Bills Sent Out Cobb County Georgia

Your Guide On Property Taxes In Atlanta Georgia Farkas Real Estate Group

Tips For Lowering Your Property Tax Bill In 2020 Atlanta Tax

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Atlanta Georgia Property Tax Calculator Fulton County Millage Rate Homestead Exemptions

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Your Guide On Property Taxes In Atlanta Georgia Farkas Real Estate Group

1 Tax How Why To Move Your Taxes To Georgia Country

Historical Georgia Tax Policy Information Ballotpedia

Property Taxes Laurens County Ga

1 Tax How Why To Move Your Taxes To Georgia Country

2021 Property Tax Bills Sent Out Cobb County Georgia

Equitax Georgia Property Tax Appeal Services Tax Liability Reduction

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute